Helping clients of Accountants, Suppliers and Business Intermediaries

How we can help

We’re specialists in proving equipment finance and leasing solutions to UK businesses and work closely with suppliers to provide highly attractive customer financing options. Our solutions are designed to help businesses of all shapes and sizes to grow through the acquisition of technology, plant equipment or machinery.

Vendor Financing Solutions

Lease Rental

Lease Purchase

Subscription Finance

Unsecured Loan

Benefits for your clients

How we can help

Whether a restaurant or manufacturing business, sole trader or large corporate our portfolio of business loan solutions ranging from 3 months to 10 years are designed to meet the requirements of business, no matter the shape or size. With over 30 years experience in providing business finance you can rest assured that your clients financing is in the right hands.

Business Loan Solutions

Tax & VAT Liabilities

General Cash Flow

Stock Purchases

Acquisitions & Buy In/Outs

Refurbishments & Renovations

Consolidation

Benefits for your business

How we can help

With 30 years of experience in financing equipment our comprehensive understanding of the many types of business critical assets ensures that we can provide your clients with access the vital finance they need, competitively. You can rely on us to ensure your client can spread the cost of equipment through a tailored Finance Lease, Hire Purchase or Unsecured Loan package simply and efficiently.

Equipment we’re regularly financing

Medical Equipment

Furniture, Fixtures & Fittings

I.T Hardware, Telephony and Software

Farming Plant, Machinery & Vehicles

Construction Plant, Machinery & Vehicles

Manufacturing Machinery & Equipment

Benefits for your business

How we can help

We understand that for many SMEs who take a significant proportion of sales via card payment, that cash flow can be incredibly tight. Our access to the major and leading Merchant Cash Advance providers makes us the ideal partner for your client. Our team ensure they can access the most competitive funding that mirrors their revenue stream, so if they have a dip in trading, repayments reduce and vice versa.

Ideal financing for

Convenience Stores

Restaurants & Takeaways

Salons & Barbers

B&B’s & Hotels

Opticians, Vets & Pharmacy’s

Retailers & Wholesalers

Benefits for your business

How we can help

At ShirePF we know that the cash conversion cycle is incredibly important for businesses with sizeable average order values. Cash flow becomes challenged when capital is tied up in debtors and conversion to cash is key. All our team are highly experienced and as we hold relationships with specialist invoice financiers that can quickly turnaround invoice financing solutions, were your ideal partner.

Selective Invoice Discounting

Funding specific invoices from a single or handful of debtors

Confidential Invoice Discounting

Funding against all your outstanding invoices

Contract Financing

Funding raised against contracts, licences and retainers

Benefits for your business

Why choose Shire Professional Funding?

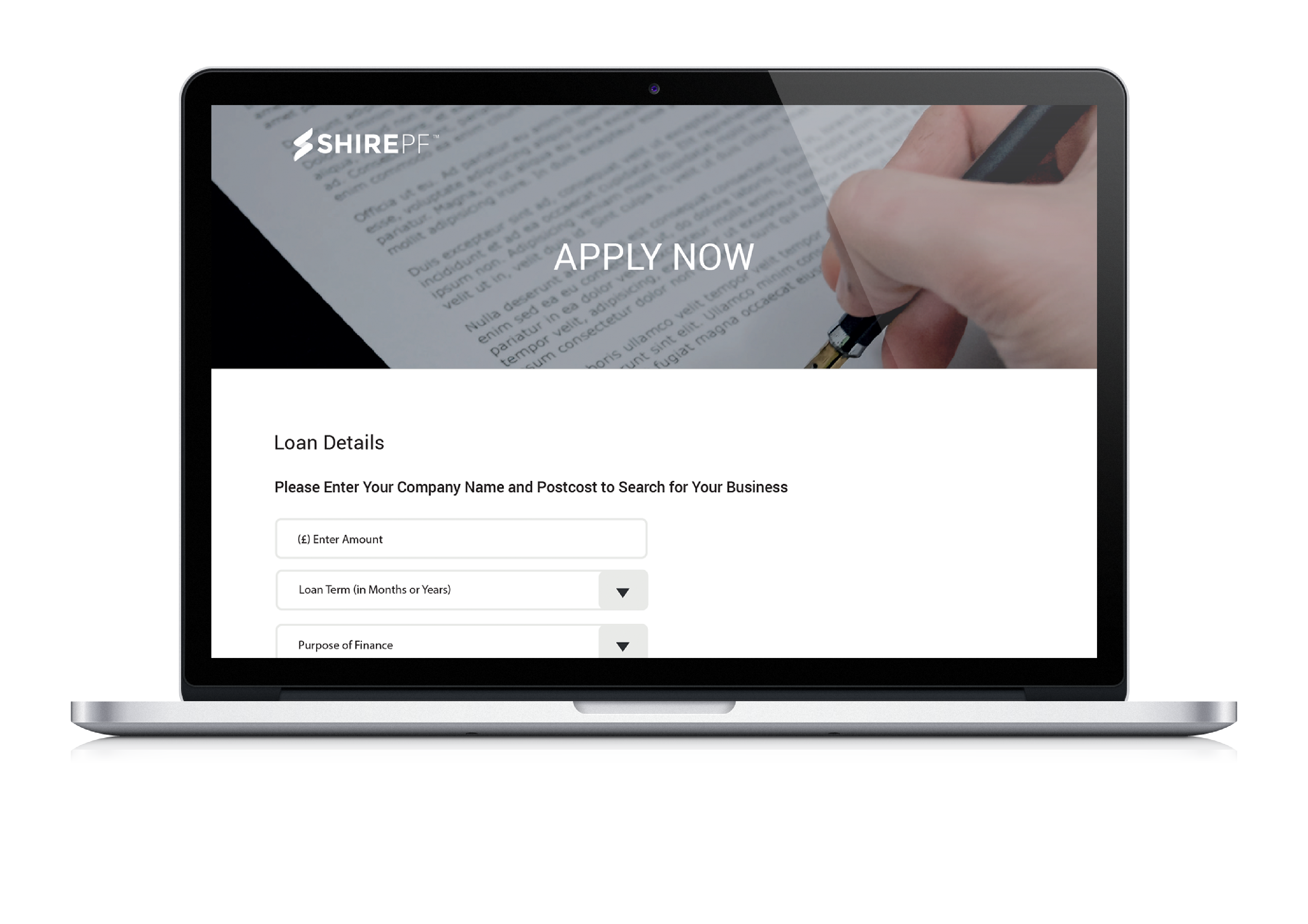

Get an Online Quote

in Minutes

Finance doesn’t have to mean hassle. Use our free, online quote generator to explore your options and find the right package for you.